Few companies embody the stakes of the geopolitical rivalry between Washington, D.C. and Beijing quite like Nvidia. The chipmaker, which became the world’s first public company worth $4 trillion USD in July, has seen unprecedented growth that comes with the recent rise of artificial intelligence. Nvidia’s aptitude for creating powerful performance chips for AI systems has propelled the company and its mastermind and CEO Jensen Huang to the highest echelons of Silicon Valley, where tech elites like Larry Ellison, co-founder of Oracle, and Elon Musk beg Huang to supply their companies with more GPUs.

Jensen Huang, the CEO of Nvidia, speaking in Las Vegas, Nevada, in January 2025. Source: Getty Images

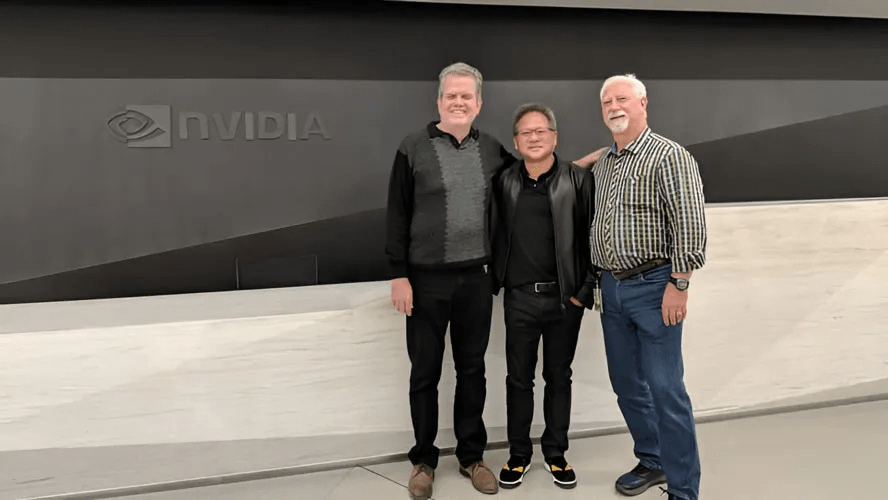

But to characterize Nvidia’s rise as immediate is unfair. The company was founded in 1993 by a trio of computer scientists: the aforementioned Huang, who at the time was working for a San Jose chipmaker, LSI Logic, as well as Chris Malachowsky and Curtis Priem, both of whom were employed by Sun Microsystems.

Malachowsky and Priem had fundamental differences with Sun Microsystems about the company’s directional development, and actively wanted out. Eventually, they were able to convince Huang, who held a steadier job, to join them in creating a revolutionary company specializing in graphics-based computer chips – Nvidia, in a breakfast booth at Denny’s.

The three Nvidia co-founders, left to right: Curtis Priem, Jensen Huang, Chris Malachowsky. Source: Nvidia

In computer chips, the three co-founders saw a pathway into the future, a solution to problems that couldn’t be tackled at the time. “We believed this model of computing could solve problems that general-purpose computing fundamentally couldn’t,” Huang noted while speaking with Fortune in 2017. “Video games [were] our killer app—a flywheel to reach large markets.” With Priem leaving the company in 2003, shortly after selling off all his shares, and Malachowsky transitioning into more of a technical role in product development, Huang was able to retain significant control of the company’s direction and expand it well past video games.

Huang was born in Taipei, Taiwan, in 1963, and his family moved to Thailand shortly after. At nine years old, Huang’s parents sent him to Tacoma, Washington, to reside with his aunt and uncle. His uncle mistakenly believed that the Oneida Baptist Institute in Kentucky, a religious reform academy for troubled teens, was actually a prestigious boarding school, and Huang’s parents sold nearly all their possessions to allow Huang and his brother to attend.

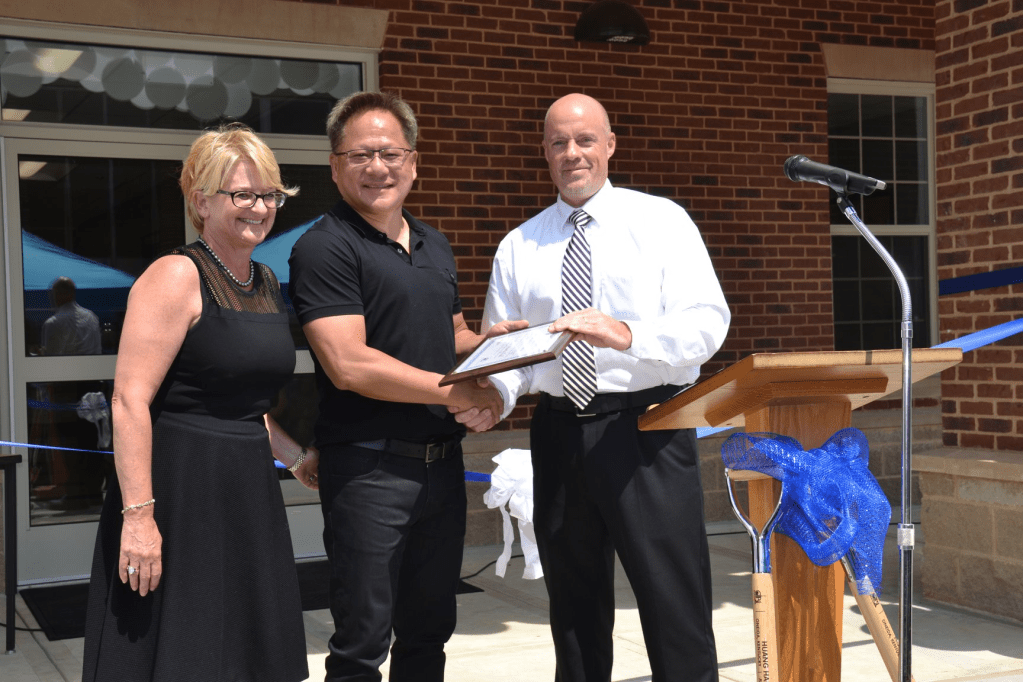

At Oneida, Huang was forced to navigate a foreign environment in what seemed like the middle of nowhere. He found himself doing mundane tasks like cleaning toilets and faced relentless bullying from his peers, who mocked his broken English. “The kids were really tough; they all had pocket knives,” Huang later recalled. Nonetheless, Huang developed his trademark persistence and determination, and even took up the sport of ping-pong, which he excelled at. He donated $2 million USD to his former school for a new girls’ dormitory and classroom building in 2019.

Jensen Huang, center, at an August 2019 dedication ceremony at Oneida Baptist Institute, his former school. Source: Oneida Baptist Institute

After completing his high school years in Oregon, Huang studied electrical engineering at Oregon State University, graduating in 1984. He obtained his master’s degree in the same discipline at Stanford University shortly before he cofounded Nvidia.

The grit of Huang’s childhood and early career defines his leadership style to this day. It exemplifies Nvidia’s ability to survive in a cutthroat economy where technology has often become a proxy for political power. As Nvidia grew from a scrappy graphics-card maker to the undisputed leader in AI chips it is today, its trajectory has become inseparable from the power dynamic between the United States and China.

Nvidia truly gained its foothold in the industry in the late 1990s, notably when it released the GeForce 256, a GPU that was so successful it won Nvidia a contract to develop the hardware for the Xbox. Nvidia showed signs of a shift beyond the gaming industry starting in the early 2000s, when the company worked with NASA to “develop a photorealistic Mars simulation” and created graphics chips for Audi.

Like most innovative companies, Nvidia also faced numerous deterrents. Its first run-in with the U.S. government was in 2006, when the company reported that it had been subpoenaed by the Department of Justice regarding possible antitrust violations within the GPU and card industries. Furthermore, the company also saw rough periods in 2010, when Nvidia settled for $193.9 million in a class-action lawsuit about faulty graphics chips and unsatisfactory packaging material used within the chips.

It was also around this time that Nvidia started expanding its development in parallel computing technology, a method of computation that executes multiple processes simultaneously to solve complex problems faster. Looking back, Nvidia’s key foresight in this field helped it tremendously a decade later with the emergence of AI, in which parallel computing technology is crucial.

The early 2010s saw Nvidia kickstart its habit of growth through acquisition. Led by Huang, the company tends to acquire brilliant companies in areas where it feels development is crucial, like its 2011 acquisition of Icera, a leading wireless modems manufacturer, or its 2013 acquisition of the Portland Group, a supplier of high-performance compilers and tools.

As the company’s success carried into the 2020s, tensions with the U.S. government about potential trusts and monopolies resurfaced. Following the announcement that Nvidia would acquire the British chip designer Arm, which develops chips for numerous household products like the iPad, iPhone, and Kindle, for $40 billion USD, the Federal Trade Commission (FTC) sued to block the acquisition.

Holly Vedova, the director of the FTC’s competition bureau at the time, declared that the deal would “allow the combined firm to unfairly undermine Nvidia’s rivals.” Regardless of the U.S. government’s intentions, these actions nonetheless raised questions about the extent of regulatory oversight towards the company. Nvidia ultimately terminated the deal in February 2022, citing “significant regulatory challenges.”

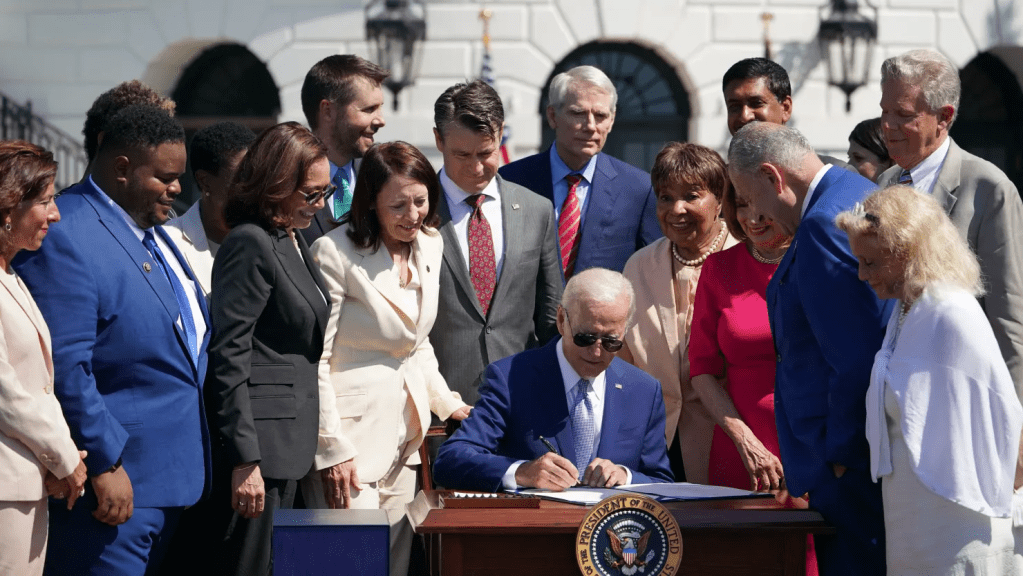

President Joe Biden also signed the “CHIPS and Science Act” into law in August 2022, which granted historic investments into American-produced chips and semiconductors. Nvidia isn’t a direct manufacturer of chips in the sense that it outsources most of its production through a network across Asia. Yet, in order to become a beneficiary and not a customer of the act, the company announced plans to produce over $500 billion USD of AI infrastructure in the U.S. over the upcoming years. It’s almost always easier and cheaper for companies to execute mass production in foreign nations where there are fewer controls and regulations, but this is a sacrifice that Nvidia must make in compliance with the United States’ growing mandates.

President Joe Biden signing the CHIPS and Science Act of 2022 into law on the South Lawn of the White House. Source: Getty Images

Nvidia’s most significant change in recent years has been its exponential growth fueled by AI investments and developments. After OpenAI’s ChatGPT, which utilized around 20,000 Nvidia graphics cards to process training data, took the world by storm, Nvidia’s earnings reports indicated improvement after improvement in quarterly gains.

But Nvidia is not just playing a stagnant game. The company is running a marathon with no finish line in sight, with innumerable realms in which the company can expand. Nvidia significantly ramped up its venture capital activity in 2024, and thus far in 2025, the company has already invested in countless billion-dollar-round AI startups, including OpenAI, xAI, and Inflection, as well as many other startups, with rounds in the hundreds of millions.

Just this past week, Nvidia announced that it would invest $5 billion USD in its struggling rival, Intel, which produces central processing units (CPUs), in contrast with Nvidia’s production of graphics processing units (GPUs). Together, the companies announced they would collaborate on creating chips specialized for personal computers and data centers.

However, much like its founder, Jensen Huang, who seemingly balances his American and Taiwanese roots, Nvidia also finds itself facing influence from another global superpower – China. Comparable to the United States, China has also hit Nvidia with antitrust and regulatory probes in the past.

On September 15th, China’s antimonopoly regulator announced that Nvidia had violated the country’s antitrust law, stemming from an investigation into the company’s 2020 acquisition of Mellanox Technologies, an Israeli computer networking manufacturer. At the time, China had approved the acquisition, but the nation has backtracked on that stance, now asserting that Nvidia had violated commitments it made during the deal to prevent anti-competitive practices.

Jensen Huang taking a picture with an attendee at the China International Supply Chain Expo in Beijing in 2025. His company, Nvidia, has been embroiled in controversies between the U.S. and China. Source: Bloomberg News

Nvidia is being caught in the crossfire of increased technological aggression between China and the U.S. In the days leading up to the decision by the Chinese government, the two nations had been exchanging blows. The U.S. had recently added 23 Chinese companies to a list of firms barred from purchasing American technology due to national security concerns, and China had responded in kind, stating that it was also conducting its own investigation into American suppliers of specific integrated circuits.

This all comes just months after the U.S. announced that it would limit exports of Nvidia’s AI server H20 chip to China. The H20 chip, although not as advanced as other chips the company offers outside of China, had been central to Chinese platforms like Alibaba, Tencent, and ByteDance. It was specifically designed to comply with previous export limitations installed by the U.S. In response, Nvidia stated that it would take $5.5 billion USD in charges, acknowledging that plethoras of its China-targeted chips are now unsellable.

Almost like a ping-pong ball going back and forth, the U.S. stance changed once again in August 2025, when Nvidia released a statement, referring to the H20 chips, saying: “The U.S. government has assured Nvidia that licenses will be granted, and Nvidia hopes to start deliveries soon.” This new declaration came a week after a meeting between President Donald Trump and Jensen Huang, where Huang affirmed his support for the Trump administration’s job goals and the aim for America to be the global leader in AI.

But this past Thursday, Beijing reportedly halted purchases of Nvidia’s RTX Pro 6000D chip along with the H20 chip, freezing the company out of China’s markets. It seems like this decision was influenced by China’s findings that Nvidia violated its antimonopoly laws, but semiconductor analysts like Qingyuan Lin believe that “all these recent actions show that China has much more confidence in their domestic sector than they used to.”

China has seen a remarkable growth in chip development over the past couple of years, with companies like SMIC and Huawei leading the way. SMIC, which stands for Semiconductor Manufacturing International Co., is a state-backed specialized chip factory that holds 6% of the market share for foundries (the third-highest in the world). Huawei, the Chinese technology company, also recently announced new computing systems for powering AI with its Ascend chips.

“The competition has undeniably arrived and is gaining momentum,” a Nvidia spokesperson told CNBC in a statement. However, Huang expressed disappointment at China’s decision to halt purchases of Nvidia’s chips, saying that “we can only be in service of a market if the country wants us to be.” It remains unclear what China’s true intent is behind these actions, whether it’s an initiative to promote domestic semiconductor manufacturing or a negotiation tactic with the United States.

What began in a Denny’s breakfast booth is now a $4 trillion enterprise entangled in the world’s most intense geopolitical rivalry between China and the United States. Nvidia’s chips power the future of AI, but they are also weapons in the struggle for technological dominance. For Jensen Huang, the tightrope is more perilous than ever: a single misstep with Washington D.C. or Beijing could undercut Nvidia’s dominance.

Leave a comment